Archives: Pension Reform / Articles

Archives: Pension Reform / Articles (page 2)

-

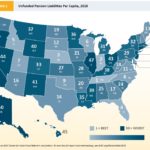

Unaccountable and Unaffordable 2019: A Snapshot of Pension Liabilities Before COVID-19

Like much of the economy, COVID-19 hit public pension investments like a wrecking ball. Early reports from Moody’s estimated that state public pension plans lost nearly $1 trillion in…

-

OPEB: The Trillion-Dollar Acronym

This article originally appeared in the March 23, 2020 edition of Tax Notes State. Upon hearing the term “OPEB,” most people look bewildered, not knowing that OPEB, short for…

-

Across the States: Market Volatility and State Solutions

Learn more about how state policymakers can best position their states to weather these challenging times of economic uncertainly. As many states look to re-evaluate their budgets to factor in…

-

Lessons from Puerto Rico’s Struggles with Debt and Unfunded Pension Liabilities

In a recent press release from the congressionally-appointed Financial Oversight & Management Board (FOMB) for Puerto Rico, the board announced that it filed its Plan of Adjustment to restructure…

-

Denying Pension Realities?

A recent paper published by the Brookings Institution claims that “there is no imminent ‘crisis’ for most pension plans.” At the risk of sounding like a naysayer, this conclusion…

-

Connecticut’s Growing Pension Crisis

A recent article in the Chief Investment Officer discussed Connecticut’s growing retirement system liabilities, citing ALEC’s Unaccountable and Unaffordable 2018 report. A March report from …

-

The Wall Street Journal Cites ALEC Pension Data

In an article titled “America’s Public Pensions Are Stuck In The Clouds,” The Wall Street Journal cited data from the recent ALEC publication, Unaccountable and Unaffordable 2018.

-

ALEC Southeastern Tax Academy a Big Success

The Center for State Fiscal Reform hosted its latest regional ALEC Academy in Myrtle Beach, South Carolina. ALEC was glad to bring the good news of tax reform and pro-growth…

-

Look to the States on Labor Policy

Following his testimony in front of the U.S. House Education and Labor Committee last week, Missouri State Senator Bob Onder penned an op-ed for the Washington Examiner, explaining that…

-

A Spark of Hope for New Jersey’s Growing Debt Problem

So long as there are those willing to have “hard and honest conversations” about unfunded liabilities, there is hope for reform.

-

The Williams Report: January 2019

BUDGET Arizona: Gov. Ducey’s Budget Proposal Adds to Arizona Education Spending Gov. Doug Ducey’s first budget since re-election contains a substantial increase in education spending. Arizona can…

-

The Williams Report: November 2018, Part 2

BUDGET Connecticut: General Assembly Democrats May Need GOP Help to Pass Next CT Budget Connecticut is currently projected to have a $2 billion deficit next budget cycle. The “volatility cap,”…

-

The Williams Report: November 2018

BUDGET Indiana: Hoosiers Will Vote “Yes” or “No” on Balanced Budget Amendment Indiana voters will decide this November whether or not state legislators must pass a balanced…

-

The Williams Report: October 2018, Part 2

BUDGET: Arkansas: Hearings on State’s Budget to Get Going As budget hearings begin, Arkansas legislators will learn the details of programmatic and state agency funding needs, and what Governor…

-

The Williams Report: October 2018

BUDGET: Alaska: New State Budget Report Predicts State Savings Accounts Will Be Empty by 2021 Alaska’s persistent funding crisis continues as the state is forced to underfund entitlements and…

-

The Williams Report, September 2018

Budget: Connecticut: Small Surplus Projected with Current Budget Two months into Connecticut’s fiscal year, the state’s budget chief is projecting a nearly $138 million operating surplus, driven…

-

The Pension Crisis is not a Black Swan Event

Close your eyes and envision a swan. What color is it? Most likely, it is a white swan. Because most of us go our entire lives coming across only white…

-

The Williams Report, August 2018

Budget: Illinois: State Admits to Billion-Dollar Budget Hole The Rauner Administration acknowledged a $1.2 billion structural deficit in an offer to sell $920 million in state bonds.

-

Chicago Pension Obligation Bonds, a Strategy or Gamble?

Chicago Mayor Rahm Emanuel’s administration is exploring the possibility of issuing billions of dollars of pension obligation bonds and investing the proceeds in order to reduce the city’s $28…

-

Converting from Defined Benefit to Defined Contribution: The “Free” Money Pays Down Unfunded Liabilities and Pays Dividends to Taxpayers

Implementing a DC system delivers immediate payroll savings for the new plan’s participants. Using these savings to shore up the unfunded liabilities from the preexisting DB plans will ensure that past promises made are kept. At the same time, the new DC plan participants rest assured that each and every paycheck, funds are being deposited into an account belonging to them. Taxpayers win as the escalation in retirement overhead costs level off and eventually realize the full benefit of the savings.