Growth in the Desert

Reforming Pensions & Taxes, Arizona Thrives in the Highly Competitive Southwest

To paraphrase a line from an unnamed presidential candidate’s stump speech, Arizona taxpayers must be getting tired of winning. Governor Doug Ducey recently signed into law a $9.6 billion budget package that funds core government services and manages to cut taxes. By abandoning the tax-and-spend playbook and prioritizing sound budgeting, state officials and legislators continue to help Arizona separate itself from economically overburdened states like Illinois and Pennsylvania (neither of which has passed a budget for the upcoming fiscal year yet). With new policies ranging from reducing the income tax burden, to deregulating the “gig economy,” to pension reform, good news in Arizona is plentiful.

Taxes, Budgets and Growth

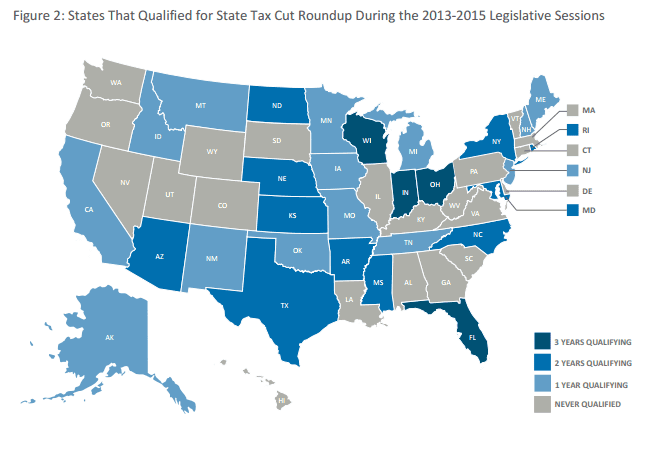

Arizona’s fiscal responsibility is translating to measurable success. In the recently released ninth edition of the Rich States, Poor States: ALEC-Laffer State Economic Competitiveness Index, Arizona maintained its top five economic outlook ranking. Given its very competitive personal and corporate income tax rates, low number of public employees relative to overall population and right-to-work status, Arizona’s strong economic outlook comes as no surprise. During the lifespan of Rich States, Poor States, Arizona has routinely proven itself a success story, only falling out of the top ten for economic outlook once, ranking 12 in 2011. From 2005 to 2014, more than 530,000 Americans have moved to Arizona from one of the other 49 states. Only Texas, Florida and North Carolina have seen greater domestic in-migration. According to the most recent data available from the Bureau of Economic Analysis, Arizona outgrew the rest of the Southwest Region by a considerable margin in the third quarter of 2015. The state’s pro-growth investment, headlined by making substantial tax cuts on net during two of the past three legislative sessions, is paying off.

Thanks to the efforts of the state legislature and the governor during the most recent legislative session, Arizona will likely maintain its competitive positioning in the coming year. In 2016, Arizona’s debt service accounts for a smaller percentage of state revenue than it did in 2015. Arizonans also enjoy a smaller property tax burden than they did a year ago. Despite being in a desert, Arizona has grown its rainy day fund from practically nonexistent in FY 2009 to a considerably more robust total now. Most importantly, residents of Arizona are enjoying the positive effects of fiscal responsibility on their wallet. The recently passed budget contains a considerable amount of pro-growth tax cuts. The tax cut package “allows businesses to more quickly depreciate the deduction they can take for purchases of new equipment,” according to the Arizona Republic. “It is estimated to cost $8 million next year, doubling to $16 million in fiscal 2018.”

Public Pension Reform

These reforms pale in comparison, however, to the enactment of Proposition 124. The Arizona Public Safety Personnel Retirement System (PSPRS) was on an unsustainable trajectory. According to Reason Foundation, which played an instrumental role in the reform, “PSPRS’s financial health over the past 12 years has led to skyrocketing annual pension costs for the local government and state agency employers participating in PSPRS and, by extension, taxpayers.” The reforms include pre-funding and indexing cost-of-living adjustments (COLA) to the Consumer Price Index, but with a two-percent cap. Additional reforms include, but are not limited to, giving new hires the option of joining defined contribution or hybrid defined benefit pension plans, limiting pensionable pay (the portion that counts toward pension accumulation) to $110,000 and raising the retirement eligibility age to 55.

“If you would have asked me back in February 2015, when we got this started, I had my doubts,” said state Senator Debbie Lesko (R-Peoria, ALEC Public Sector State Chair, ALEC Women’s Caucus Chair), a sponsor and integral proponent of the measure. “That first meeting was very contentious. But in the end, we all became friends and we had mutual respect for each other.”

Proposition 124 received overwhelming support; think tanks saw it as good policy, union members and pensioners accepted fiscal reality and budget hawks saw an opportunity for real reform. The reform was ultimately endorsed by the Arizona Republic, Professional Firefighters of Arizona, and the Arizona Fraternal Order of Police. As noted by the Arizona Republic, “There’s a reason no one filed arguments against reforms for Arizona police and fire pension funds.” In the end, all parties agreed to reasonable reforms, Arizona’s police and fire pensions became more sustainable, and the Arizona taxpayer is estimated to save $1.5 billion over the next 30 years.

Unshackling Innovation and the Sharing Economy

Whether it’s called the gig economy, sharing economy or platform economy, Governor Ducey has been a staunch ally and proponent of letting the industry grow and thrive. “Stop shackling innovation, and instead – put the cuffs on out-of-touch regulators,” said Ducey in his most recent State of the State Address. “I want startups in the sharing economy to know: California may not want you, but Arizona Does.”

Arizona’s officials proved they want the new sector to grow. Starting later this month, Uber and Lyft will be fully legalized to operate at Sky Harbor International Airport. A pet issue of the governor’s, pressure was put onto Phoenix officials who voted to allow the ride sharing companies to operate at the airport for a small fee, an arrangement not uncommon among many airports. Municipal regulation of the sharing economy is an ongoing concern across the states beyond ridesharing. Short-term rentals, such as those arranged by Airbnb and HomeAway, are also seeing regulatory creep. In an effort to get out of the way of a nascent industry, Senator Lesko was the chief sponsor of the recently-passed SB 1350, which prohibits municipal bans on short-term rentals.

Conclusion

Some states simply understand the proper role of government better than others. While states like Illinois fail to pass a budget entirely, Arizona’s budgeting process prevails to the benefit of the taxpayer. While states like California have rapidly-vanishing “surpluses” and call for tax increases, Arizona manages tax cuts while bolstering the Rainy Day Fund. Austin, Texas, despite being in a free-market state, hampers ridesharing services; Arizona allows them to flourish. The example set by Arizona should be instructive to the rest of the country: fiscally responsible, pro-growth policies are the foundation of success and ultimately more attractive to Americans than any amount of preferential handouts and taxpayer funded boondoggles.